Fast cash loans can be a life-saver, but this short-term solution it can also be a cause of more problems. This depends on the situation and how you were able to manage the loan. Lenders of fast cash advances will just usually require minimum requirements for approval of loan application. So, it is up to the borrowers to determine and assess deeply their financial status whether the pros upstage the cons when it comes to fast cash advance loans.

The Good

Fast. The number one advantage of applying for these types of cash loan is the speed of approval and turnover of money to borrowers. Some online fast cash lenders can deposit the amount to your bank account immediately right after your application was approved within the day. This is especially helpful if the reason for borrowing entails urgent actions, as with a medical emergency or accident, or primary property damage such as car or house.

The Good

Fast. The number one advantage of applying for these types of cash loan is the speed of approval and turnover of money to borrowers. Some online fast cash lenders can deposit the amount to your bank account immediately right after your application was approved within the day. This is especially helpful if the reason for borrowing entails urgent actions, as with a medical emergency or accident, or primary property damage such as car or house.

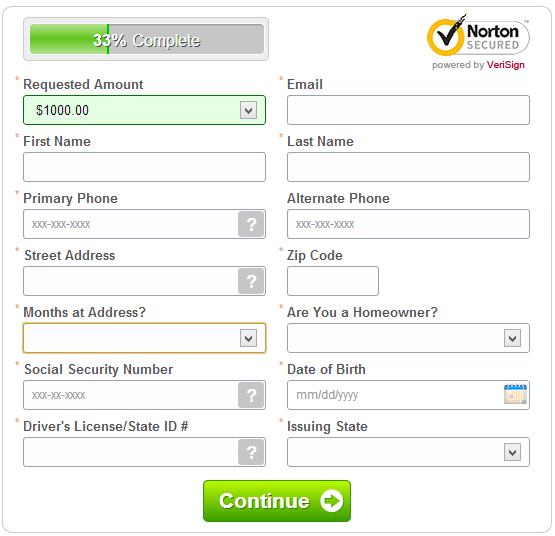

No fuss. To avail of fast cash loans, you usually do not need to undergo a long and detailed process of application, as usually required with traditional loans. There will be no review of credit status and financial history. You will not be asked to present collateral or look for a guarantor. There's no ITR form, proof of assets and other paperwork to file. All you usually need is to prove that you have a regular steady source of income within the set minimum bracket, a bank checking account, and your loan is approved in minutes.

Flexible. A payday advance lender will not ask you to provide a reasonable purpose for needing the loan. Compare this to borrowing, such as a business loan, in a traditional financial institution where you will need to undergo an interview to justify your application. You can use the loan for personal, business and other purposes, and you will not be asked to state the reason.

The Not-so Good

High Interest. Payday lending businesses usually implements a substantial interest rate that accumulates as quickly as you got the cash advance. Thus, if you're getting a fast cash loan, be sure that you can afford to pay off the entire amount quickly or else risk on being drowned in a cycle of debt.

Additional fees. Finance charges, credit coasts, loan and processing fees can add up to the original amount you intend to borrow. Lending companies of fast cash loans also charge higher than average late payment fines, which, coupled with the high interest, can heavily make a dent on your finances.

Fast Cash Loans can be a helpful way to survive an emergency financial problem, but be sure to consider both the benefits and risks of availing of Top Rated Fast Cash Loans to avoid getting into further money dilemma.