Cash Loan Fast No Faxing

Sunday, December 15, 2013

Wednesday, December 11, 2013

Two Sides of Fast Cash Loans

Fast cash loans can be a life-saver, but this short-term solution it can also be a cause of more problems. This depends on the situation and how you were able to manage the loan. Lenders of fast cash advances will just usually require minimum requirements for approval of loan application. So, it is up to the borrowers to determine and assess deeply their financial status whether the pros upstage the cons when it comes to fast cash advance loans.

The Good

Fast. The number one advantage of applying for these types of cash loan is the speed of approval and turnover of money to borrowers. Some online fast cash lenders can deposit the amount to your bank account immediately right after your application was approved within the day. This is especially helpful if the reason for borrowing entails urgent actions, as with a medical emergency or accident, or primary property damage such as car or house.

The Good

Fast. The number one advantage of applying for these types of cash loan is the speed of approval and turnover of money to borrowers. Some online fast cash lenders can deposit the amount to your bank account immediately right after your application was approved within the day. This is especially helpful if the reason for borrowing entails urgent actions, as with a medical emergency or accident, or primary property damage such as car or house.

No fuss. To avail of fast cash loans, you usually do not need to undergo a long and detailed process of application, as usually required with traditional loans. There will be no review of credit status and financial history. You will not be asked to present collateral or look for a guarantor. There's no ITR form, proof of assets and other paperwork to file. All you usually need is to prove that you have a regular steady source of income within the set minimum bracket, a bank checking account, and your loan is approved in minutes.

Flexible. A payday advance lender will not ask you to provide a reasonable purpose for needing the loan. Compare this to borrowing, such as a business loan, in a traditional financial institution where you will need to undergo an interview to justify your application. You can use the loan for personal, business and other purposes, and you will not be asked to state the reason.

The Not-so Good

High Interest. Payday lending businesses usually implements a substantial interest rate that accumulates as quickly as you got the cash advance. Thus, if you're getting a fast cash loan, be sure that you can afford to pay off the entire amount quickly or else risk on being drowned in a cycle of debt.

Additional fees. Finance charges, credit coasts, loan and processing fees can add up to the original amount you intend to borrow. Lending companies of fast cash loans also charge higher than average late payment fines, which, coupled with the high interest, can heavily make a dent on your finances.

Fast Cash Loans can be a helpful way to survive an emergency financial problem, but be sure to consider both the benefits and risks of availing of Top Rated Fast Cash Loans to avoid getting into further money dilemma.

Direct Payday Loan Lenders Top Payoff Priority List

If you are caught up in debt from fast direct payday loan lenders as well as creditors, mortgages, car loans and possibly even student loan debt you are not alone. The household debt crisis is more than most incomes can handle. Finding money options with a load of current debt is tough. Payday loan help has increased while debt loads continue to make monthly budget matters difficult.

Once banks and credit cards no longer help foot the bill, people turn to alternative money options. Lots of people unsuccessfully search for a second job, while others unload their closets and basements to make ends meet. When there are other unexpected costs that pop in during tight money times, frustration and hopelessness often settles in. Direct payday online loans, title loans and pawn loans end up coming to the rescue... at least for the moment.

Once banks and credit cards no longer help foot the bill, people turn to alternative money options. Lots of people unsuccessfully search for a second job, while others unload their closets and basements to make ends meet. When there are other unexpected costs that pop in during tight money times, frustration and hopelessness often settles in. Direct payday online loans, title loans and pawn loans end up coming to the rescue... at least for the moment.

Yes, these short-term alternative money options do bring in fast cash when you need it the most. At least it will for those who qualify or have value to personal property. Most homeowners have a car, but they don't all own the pink slip. Unless a person is able to be approved for one of these options, there is even more despair.

Some people have family and friends to borrow quick cash. Others wouldn't dare or have already burned those bridges. It's tough when money problems are a constant. At that point there really is no other option but to cut way back on expenses. Sometimes the hard road will bring the most success, even if you have to downsize your home or apartment.

It's important to get rid of debt as best as you can if your household struggles month to month. It is easier said than done, but it can be done if you make a plan and stick to it. There is no way any budget can afford to keep using short-term direct payday loans every month. Even if you have only used one of these loans but can't seem to pay it off, you can't afford it. Before you risk any personal items as collateral, really think about what you are going to do to make sure you get it paid off fast.

Would paying off credit cards with high interest rates work best for you? Are you a person who likes to see check-marked accomplishments and work at getting rid of the smallest debts first? Financial experts can argue which is best, but when it comes down to being in a pit of debt, you do what you need to do to motivate yourself out of it.

Put your credit card statements up on the wall. You won't forget the objective. Make yourself lists, create spreadsheets, and sign up for a free smartphone app to organize your funds. There is enough free help out there to get you started.

You don't have to live a life where the payday loan lender is on your speed dial. You will have to change spending habits. Your family will have to cut back on many 'extras' they may have become accustomed to. Reward yourself and even your family every time you reach a goal whether it is long or short-term. Success needs to be celebrated to keep the momentum going.

Read This Before You Apply For a Fast Cash Loan

Lots of people need a short term loan at least one or twice in their lives, and many of them either don't have a friend or family member to borrow from, or they'd rather not ask them for help.

Often, the only available alternative is to take out what is commonly known as a 'fast cash loan', and there are several types of them available such as, payday loans, instant online payday loans, and instant cash loans etc. but whatever name they go by, they all have one thing in common and that's that their interest rates are exceptionally high.

Often, the only available alternative is to take out what is commonly known as a 'fast cash loan', and there are several types of them available such as, payday loans, instant online payday loans, and instant cash loans etc. but whatever name they go by, they all have one thing in common and that's that their interest rates are exceptionally high.

There are several upsides to these loans of course, and they are that almost everyone can qualify for one of them, they can be applied for on-line, and the money more often than not arrives within twenty four hours, except if you request one just before a weekend or a public holiday.

It's common thinking when needing one of these loans to simply think that the high interest is what it is, and that there's simply no way to avoid the elevated cost. This is not true however, because the amount that the borrower will have to pay back, can be reduced simply by following a few simple steps.

The most obvious first step, but often an overlooked one is not to request the loan until the very last moment, and the reason for this is that you'll begin paying interest of perhaps 20% per week from the moment you get the money. In the same vein, you should pay it back as soon as you possibly can, because the last thing that you want is for the loan to roll over and to have interest added to the interest.

Rather surprisingly, it's quite common for people that have poor credit ratings to borrow much more than they actually need when they apply for a 'fast cash loan', simply because they know that their credit won't be checked. Frequently, the only available option is to take out what is commonly known as a 'fast cash loan', and there are several types of them available such as, instant online payday loans, payday loans, and instant cash loans etc.

After you've figured out the minimum that you can make do with and you know the latest date that you have to have it by, you should start comparing some online companies and carefully check both the interest rates and the terms of the loan because they'll both vary quite a lot. Check to see, if the loan is for a fixed term such as a week or a month, if there are any upfront charges, if there is a minimum amount that you have to borrow, and last but not least, how long it will take for you to get your hands on the money.

In conclusion, be sure that a 'fast cash loan' is really what you need, and that a different type of loan wouldn't better suit your needs. There are many different types of loans available and they will all be cheaper than a 'fast cash loan', and many of them won't take much longer to process.

If you're credit rating is reasonably good and you can wait just a few days for approval, then consider that route, and if you have a good income and some equity then you'll save yourself a lot of money and pressure by taking out a loan for a couple of thousand dollars that's repayable over a much longer period of time.

If you don't have time, a good credit rating or some kind of equity, but you do have a good friend or family member that can help, then do consider telling them that you're about to take out a short term loan and tell them what it's going to cost you. The chances are good that they'll help you, but make sure that you pay them back on time too, because losing friendship is far worse than losing money.

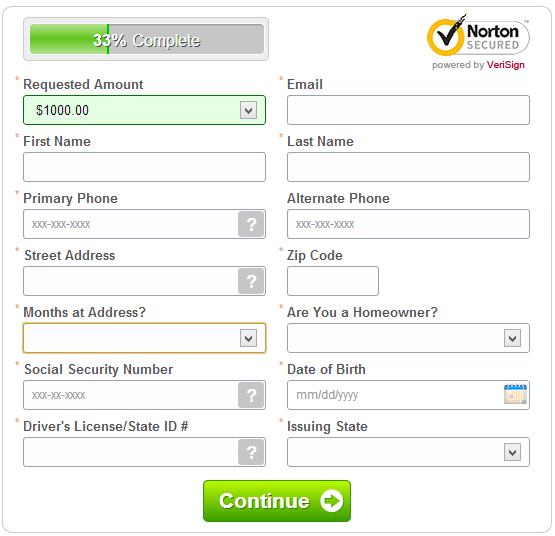

Fast Cash Loan Applications

When talking about fast cash loan applications, the principal sources of long-term finance for business firms are equity capital, preference capital, debenture capital and term loans. Equity capital is actually ownership capital, since equity shareholders own the company. They enjoy rewards, but also bear the risks of, ownership. However, their liability, unlike the liability of the owner in a proprietary firm and the partners in a partnership concern, is limited to their capital contributions.

Preference capital represents a hybrid form of financing- it partakes of some characteristics of equity and some attributes of debentures. It resembles equity in such a way that preference divided is payable only out of distributable profits and preference dividend is not an obligatory payment.

Term loans, also referred to as finance loans,

represent a source of debt finance, which is generally repayable in more than one year but less than 10 years. They are employed to finance acquisition of fixed assets and working capital margin. Term loans differ from short-term bank loans which are employed to finance short-term working capital needs and tend to be self-liquidating over a period of time usually less than one year. Term loans typically represent secured borrowing. Usually, assets that are financed with the proceeds of the term provide the prime security. Other assets of the firm may serve as collateral security.Preference capital represents a hybrid form of financing- it partakes of some characteristics of equity and some attributes of debentures. It resembles equity in such a way that preference divided is payable only out of distributable profits and preference dividend is not an obligatory payment.

Term loans, also referred to as finance loans,

All loans provided by financial institutions, along with interest, liquidated damages, commitment charges, expenses etc are secured by the way of first equitable mortgage of all immovable properties of the borrower, both present and future and hypothecation of all movable properties of the borrower, both present and future, subject to prior charges in favor of commercial banks for obtaining working capital advance in the normal course of business. The interest on term loans is a statutory obligation that is payable irrespective of the financial situation of the firm.

Searching for a Fast Cash Loan

If you find yourself a bit short of funds and need a little extra to cover your expenses, you might want to consider looking for a fast cash loan.

A fast cash loan is one that is designed to provide temporary assistance to individuals so that they'll be able to cover short-term expenses without having to worry about a long-term loan that will be charging interest the entire time.

In many cases, a fast cash loan can be relatively interest-free; a service charge is added to the amount that is borrowed, but many such loans can be repaid before the interest begins to be charged. Common fast cash loans include paycheque advance loans and short-term secured loans that can be quickly paid in full.

A fast cash loan is one that is designed to provide temporary assistance to individuals so that they'll be able to cover short-term expenses without having to worry about a long-term loan that will be charging interest the entire time.

In many cases, a fast cash loan can be relatively interest-free; a service charge is added to the amount that is borrowed, but many such loans can be repaid before the interest begins to be charged. Common fast cash loans include paycheque advance loans and short-term secured loans that can be quickly paid in full.

How the Loan Works

When you're applying for a fast cash loan, you'll be receiving a loan that can generally be repaid in a matter of weeks instead of months or years like some other loans. The borrowed amount will generally be much lower than many other loans, as it's merely designed to last you until your next paycheque or to cover emergency expenses instead of to finance larger projects or purchases.

While the loan may be smaller in scope than many other loans, this has the advantage of allowing you to borrow the money that you need with a minimal impact on your credit rating and with a much faster turnaround time than larger loans that require loan decisions to be made by lending officials.

Secured or Unsecured

In many cases, the fast cash loan that you apply for will be an unsecured loan. The reason for this is that most of these loans are relatively low in value and therefore you don't pose as much of a risk of not repaying the loan and causing the lender to be out a large sum of money.

Additionally, many lenders who offer these loans require you to write a postdated cheque that is kept on deposit with them... if you haven't repaid the loan by the due date, then they will either attempt further collection methods or simply cash the cheque.

There are some lenders who offer larger loans that are secured, though the collateral used to guarantee repayment is generally along the lines of automotive titles or other high-value collateral that is worth considerably more than the amount borrowed from the lender.

Deciding Whether to Compare Loans

Many of the times when you're looking for a fast cash loan you'll find that it simply isn't worth the time and effort to compare different lenders in order to find the best interest rates and loan terms.

Many of these lenders simply add a service charge to the amount that you're borrowing instead of presenting you with an interest rate, and often these service charges are around the same amount.

If you're taking out a slightly larger loan using collateral as a guarantee, though, then you might want to take the time to compare different lenders in your area.

Finding a Lender

Often, you'll find it rather easy to find lenders who will offer you a fast cash loan... they generally advertise the fact on their storefront and much of their televised, print, and radio advertising is aimed at individuals who are looking for fast and hassle-free short-term loans.

All You Should Know About Fast Cash Loans

The need for a fast cash loan is bound to arise at least once in a person's life. There are plenty of reasons a person would choose to apply for a fast cash loan. It's obvious that most people are not made of money, and there are undoubtedly a lot of things in life to pay for.

Long gone are the days of good credit. Most people have become so far in debt in one way or another that it's very rare to find someone who has perfect credit. Fortunately, loan companies understand this dilemma and most of them do not require you to have any credit at all. The only downside is that people are limited to the amount of money they can borrow - but of course, that can also be looked at as a good thing.

Long gone are the days of good credit. Most people have become so far in debt in one way or another that it's very rare to find someone who has perfect credit. Fortunately, loan companies understand this dilemma and most of them do not require you to have any credit at all. The only downside is that people are limited to the amount of money they can borrow - but of course, that can also be looked at as a good thing.

A fast cash loan has to be paid back. Interest rates can be rather high depending on the company you choose to obtain a loan from. There are online companies as well as companies in your local city and surrounding areas. If you are going to apply for a fast cash loan, it is advised that you take some time and shop around before making a final decision. The number-one quality to look for in a loan company is convenience and affordable payments.

A company that charges too much interest should be avoided. There are plenty of companies out there that will charge you "an arm and a leg" when you borrow from them. Oftentimes, this results in the individual falling even further into debt due to the high interest rates.

If possible, it is best to avoid obtaining a fast cash loan altogether. The reason is obviously due to the interest rates and the fact that you do have to eventually pay back the borrowed amount in full. This is something that borrowers often do not think about. Be careful about the amount of money you request when obtaining a loan to avoid paying back much more than you can afford.

Other options for obtaining the money you need include requesting overtime at your place of employment, asking a friend or family member for the funds you need, having a yard sale to earn some extra cash, as well as cutting back on the amount money you currently spend and saving your money until the desired amount is obtained. If you find that you are out of options and simply cannot ask for money, work overtime, etc., then a loan is obviously necessary.

A fast cash loan can inevitably save you from getting even further behind on your bills assuming that you have the funds to repay the borrowed amount. If you need more money than what you qualify for at a certain company, you can also apply at other loan companies until you have collected the desired amount. Payments are usually stretched out over a long period of time, providing you with the opportunity to still have money at the end of the week. If you get behind, most companies will work with you until you can get caught up on payments. All in all, applying for a fast cash loan is a great choice when you need it.

Subscribe to:

Posts (Atom)