Sunday, December 15, 2013

Wednesday, December 11, 2013

Two Sides of Fast Cash Loans

Fast cash loans can be a life-saver, but this short-term solution it can also be a cause of more problems. This depends on the situation and how you were able to manage the loan. Lenders of fast cash advances will just usually require minimum requirements for approval of loan application. So, it is up to the borrowers to determine and assess deeply their financial status whether the pros upstage the cons when it comes to fast cash advance loans.

The Good

Fast. The number one advantage of applying for these types of cash loan is the speed of approval and turnover of money to borrowers. Some online fast cash lenders can deposit the amount to your bank account immediately right after your application was approved within the day. This is especially helpful if the reason for borrowing entails urgent actions, as with a medical emergency or accident, or primary property damage such as car or house.

The Good

Fast. The number one advantage of applying for these types of cash loan is the speed of approval and turnover of money to borrowers. Some online fast cash lenders can deposit the amount to your bank account immediately right after your application was approved within the day. This is especially helpful if the reason for borrowing entails urgent actions, as with a medical emergency or accident, or primary property damage such as car or house.

No fuss. To avail of fast cash loans, you usually do not need to undergo a long and detailed process of application, as usually required with traditional loans. There will be no review of credit status and financial history. You will not be asked to present collateral or look for a guarantor. There's no ITR form, proof of assets and other paperwork to file. All you usually need is to prove that you have a regular steady source of income within the set minimum bracket, a bank checking account, and your loan is approved in minutes.

Flexible. A payday advance lender will not ask you to provide a reasonable purpose for needing the loan. Compare this to borrowing, such as a business loan, in a traditional financial institution where you will need to undergo an interview to justify your application. You can use the loan for personal, business and other purposes, and you will not be asked to state the reason.

The Not-so Good

High Interest. Payday lending businesses usually implements a substantial interest rate that accumulates as quickly as you got the cash advance. Thus, if you're getting a fast cash loan, be sure that you can afford to pay off the entire amount quickly or else risk on being drowned in a cycle of debt.

Additional fees. Finance charges, credit coasts, loan and processing fees can add up to the original amount you intend to borrow. Lending companies of fast cash loans also charge higher than average late payment fines, which, coupled with the high interest, can heavily make a dent on your finances.

Fast Cash Loans can be a helpful way to survive an emergency financial problem, but be sure to consider both the benefits and risks of availing of Top Rated Fast Cash Loans to avoid getting into further money dilemma.

Direct Payday Loan Lenders Top Payoff Priority List

If you are caught up in debt from fast direct payday loan lenders as well as creditors, mortgages, car loans and possibly even student loan debt you are not alone. The household debt crisis is more than most incomes can handle. Finding money options with a load of current debt is tough. Payday loan help has increased while debt loads continue to make monthly budget matters difficult.

Once banks and credit cards no longer help foot the bill, people turn to alternative money options. Lots of people unsuccessfully search for a second job, while others unload their closets and basements to make ends meet. When there are other unexpected costs that pop in during tight money times, frustration and hopelessness often settles in. Direct payday online loans, title loans and pawn loans end up coming to the rescue... at least for the moment.

Once banks and credit cards no longer help foot the bill, people turn to alternative money options. Lots of people unsuccessfully search for a second job, while others unload their closets and basements to make ends meet. When there are other unexpected costs that pop in during tight money times, frustration and hopelessness often settles in. Direct payday online loans, title loans and pawn loans end up coming to the rescue... at least for the moment.

Yes, these short-term alternative money options do bring in fast cash when you need it the most. At least it will for those who qualify or have value to personal property. Most homeowners have a car, but they don't all own the pink slip. Unless a person is able to be approved for one of these options, there is even more despair.

Some people have family and friends to borrow quick cash. Others wouldn't dare or have already burned those bridges. It's tough when money problems are a constant. At that point there really is no other option but to cut way back on expenses. Sometimes the hard road will bring the most success, even if you have to downsize your home or apartment.

It's important to get rid of debt as best as you can if your household struggles month to month. It is easier said than done, but it can be done if you make a plan and stick to it. There is no way any budget can afford to keep using short-term direct payday loans every month. Even if you have only used one of these loans but can't seem to pay it off, you can't afford it. Before you risk any personal items as collateral, really think about what you are going to do to make sure you get it paid off fast.

Would paying off credit cards with high interest rates work best for you? Are you a person who likes to see check-marked accomplishments and work at getting rid of the smallest debts first? Financial experts can argue which is best, but when it comes down to being in a pit of debt, you do what you need to do to motivate yourself out of it.

Put your credit card statements up on the wall. You won't forget the objective. Make yourself lists, create spreadsheets, and sign up for a free smartphone app to organize your funds. There is enough free help out there to get you started.

You don't have to live a life where the payday loan lender is on your speed dial. You will have to change spending habits. Your family will have to cut back on many 'extras' they may have become accustomed to. Reward yourself and even your family every time you reach a goal whether it is long or short-term. Success needs to be celebrated to keep the momentum going.

Read This Before You Apply For a Fast Cash Loan

Lots of people need a short term loan at least one or twice in their lives, and many of them either don't have a friend or family member to borrow from, or they'd rather not ask them for help.

Often, the only available alternative is to take out what is commonly known as a 'fast cash loan', and there are several types of them available such as, payday loans, instant online payday loans, and instant cash loans etc. but whatever name they go by, they all have one thing in common and that's that their interest rates are exceptionally high.

Often, the only available alternative is to take out what is commonly known as a 'fast cash loan', and there are several types of them available such as, payday loans, instant online payday loans, and instant cash loans etc. but whatever name they go by, they all have one thing in common and that's that their interest rates are exceptionally high.

There are several upsides to these loans of course, and they are that almost everyone can qualify for one of them, they can be applied for on-line, and the money more often than not arrives within twenty four hours, except if you request one just before a weekend or a public holiday.

It's common thinking when needing one of these loans to simply think that the high interest is what it is, and that there's simply no way to avoid the elevated cost. This is not true however, because the amount that the borrower will have to pay back, can be reduced simply by following a few simple steps.

The most obvious first step, but often an overlooked one is not to request the loan until the very last moment, and the reason for this is that you'll begin paying interest of perhaps 20% per week from the moment you get the money. In the same vein, you should pay it back as soon as you possibly can, because the last thing that you want is for the loan to roll over and to have interest added to the interest.

Rather surprisingly, it's quite common for people that have poor credit ratings to borrow much more than they actually need when they apply for a 'fast cash loan', simply because they know that their credit won't be checked. Frequently, the only available option is to take out what is commonly known as a 'fast cash loan', and there are several types of them available such as, instant online payday loans, payday loans, and instant cash loans etc.

After you've figured out the minimum that you can make do with and you know the latest date that you have to have it by, you should start comparing some online companies and carefully check both the interest rates and the terms of the loan because they'll both vary quite a lot. Check to see, if the loan is for a fixed term such as a week or a month, if there are any upfront charges, if there is a minimum amount that you have to borrow, and last but not least, how long it will take for you to get your hands on the money.

In conclusion, be sure that a 'fast cash loan' is really what you need, and that a different type of loan wouldn't better suit your needs. There are many different types of loans available and they will all be cheaper than a 'fast cash loan', and many of them won't take much longer to process.

If you're credit rating is reasonably good and you can wait just a few days for approval, then consider that route, and if you have a good income and some equity then you'll save yourself a lot of money and pressure by taking out a loan for a couple of thousand dollars that's repayable over a much longer period of time.

If you don't have time, a good credit rating or some kind of equity, but you do have a good friend or family member that can help, then do consider telling them that you're about to take out a short term loan and tell them what it's going to cost you. The chances are good that they'll help you, but make sure that you pay them back on time too, because losing friendship is far worse than losing money.

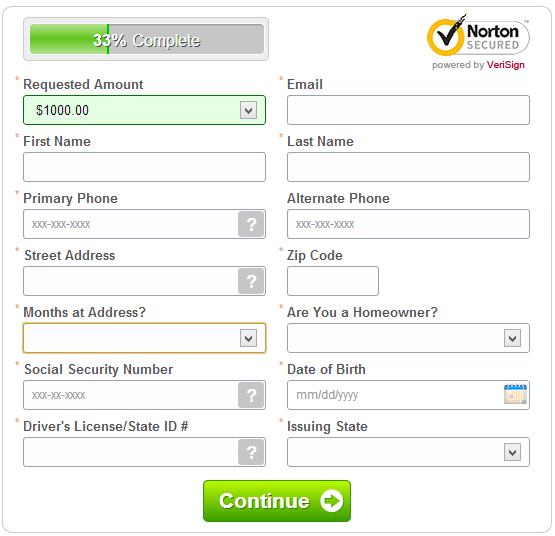

Fast Cash Loan Applications

When talking about fast cash loan applications, the principal sources of long-term finance for business firms are equity capital, preference capital, debenture capital and term loans. Equity capital is actually ownership capital, since equity shareholders own the company. They enjoy rewards, but also bear the risks of, ownership. However, their liability, unlike the liability of the owner in a proprietary firm and the partners in a partnership concern, is limited to their capital contributions.

Preference capital represents a hybrid form of financing- it partakes of some characteristics of equity and some attributes of debentures. It resembles equity in such a way that preference divided is payable only out of distributable profits and preference dividend is not an obligatory payment.

Term loans, also referred to as finance loans,

represent a source of debt finance, which is generally repayable in more than one year but less than 10 years. They are employed to finance acquisition of fixed assets and working capital margin. Term loans differ from short-term bank loans which are employed to finance short-term working capital needs and tend to be self-liquidating over a period of time usually less than one year. Term loans typically represent secured borrowing. Usually, assets that are financed with the proceeds of the term provide the prime security. Other assets of the firm may serve as collateral security.Preference capital represents a hybrid form of financing- it partakes of some characteristics of equity and some attributes of debentures. It resembles equity in such a way that preference divided is payable only out of distributable profits and preference dividend is not an obligatory payment.

Term loans, also referred to as finance loans,

All loans provided by financial institutions, along with interest, liquidated damages, commitment charges, expenses etc are secured by the way of first equitable mortgage of all immovable properties of the borrower, both present and future and hypothecation of all movable properties of the borrower, both present and future, subject to prior charges in favor of commercial banks for obtaining working capital advance in the normal course of business. The interest on term loans is a statutory obligation that is payable irrespective of the financial situation of the firm.

Searching for a Fast Cash Loan

If you find yourself a bit short of funds and need a little extra to cover your expenses, you might want to consider looking for a fast cash loan.

A fast cash loan is one that is designed to provide temporary assistance to individuals so that they'll be able to cover short-term expenses without having to worry about a long-term loan that will be charging interest the entire time.

In many cases, a fast cash loan can be relatively interest-free; a service charge is added to the amount that is borrowed, but many such loans can be repaid before the interest begins to be charged. Common fast cash loans include paycheque advance loans and short-term secured loans that can be quickly paid in full.

A fast cash loan is one that is designed to provide temporary assistance to individuals so that they'll be able to cover short-term expenses without having to worry about a long-term loan that will be charging interest the entire time.

In many cases, a fast cash loan can be relatively interest-free; a service charge is added to the amount that is borrowed, but many such loans can be repaid before the interest begins to be charged. Common fast cash loans include paycheque advance loans and short-term secured loans that can be quickly paid in full.

How the Loan Works

When you're applying for a fast cash loan, you'll be receiving a loan that can generally be repaid in a matter of weeks instead of months or years like some other loans. The borrowed amount will generally be much lower than many other loans, as it's merely designed to last you until your next paycheque or to cover emergency expenses instead of to finance larger projects or purchases.

While the loan may be smaller in scope than many other loans, this has the advantage of allowing you to borrow the money that you need with a minimal impact on your credit rating and with a much faster turnaround time than larger loans that require loan decisions to be made by lending officials.

Secured or Unsecured

In many cases, the fast cash loan that you apply for will be an unsecured loan. The reason for this is that most of these loans are relatively low in value and therefore you don't pose as much of a risk of not repaying the loan and causing the lender to be out a large sum of money.

Additionally, many lenders who offer these loans require you to write a postdated cheque that is kept on deposit with them... if you haven't repaid the loan by the due date, then they will either attempt further collection methods or simply cash the cheque.

There are some lenders who offer larger loans that are secured, though the collateral used to guarantee repayment is generally along the lines of automotive titles or other high-value collateral that is worth considerably more than the amount borrowed from the lender.

Deciding Whether to Compare Loans

Many of the times when you're looking for a fast cash loan you'll find that it simply isn't worth the time and effort to compare different lenders in order to find the best interest rates and loan terms.

Many of these lenders simply add a service charge to the amount that you're borrowing instead of presenting you with an interest rate, and often these service charges are around the same amount.

If you're taking out a slightly larger loan using collateral as a guarantee, though, then you might want to take the time to compare different lenders in your area.

Finding a Lender

Often, you'll find it rather easy to find lenders who will offer you a fast cash loan... they generally advertise the fact on their storefront and much of their televised, print, and radio advertising is aimed at individuals who are looking for fast and hassle-free short-term loans.

All You Should Know About Fast Cash Loans

The need for a fast cash loan is bound to arise at least once in a person's life. There are plenty of reasons a person would choose to apply for a fast cash loan. It's obvious that most people are not made of money, and there are undoubtedly a lot of things in life to pay for.

Long gone are the days of good credit. Most people have become so far in debt in one way or another that it's very rare to find someone who has perfect credit. Fortunately, loan companies understand this dilemma and most of them do not require you to have any credit at all. The only downside is that people are limited to the amount of money they can borrow - but of course, that can also be looked at as a good thing.

Long gone are the days of good credit. Most people have become so far in debt in one way or another that it's very rare to find someone who has perfect credit. Fortunately, loan companies understand this dilemma and most of them do not require you to have any credit at all. The only downside is that people are limited to the amount of money they can borrow - but of course, that can also be looked at as a good thing.

A fast cash loan has to be paid back. Interest rates can be rather high depending on the company you choose to obtain a loan from. There are online companies as well as companies in your local city and surrounding areas. If you are going to apply for a fast cash loan, it is advised that you take some time and shop around before making a final decision. The number-one quality to look for in a loan company is convenience and affordable payments.

A company that charges too much interest should be avoided. There are plenty of companies out there that will charge you "an arm and a leg" when you borrow from them. Oftentimes, this results in the individual falling even further into debt due to the high interest rates.

If possible, it is best to avoid obtaining a fast cash loan altogether. The reason is obviously due to the interest rates and the fact that you do have to eventually pay back the borrowed amount in full. This is something that borrowers often do not think about. Be careful about the amount of money you request when obtaining a loan to avoid paying back much more than you can afford.

Other options for obtaining the money you need include requesting overtime at your place of employment, asking a friend or family member for the funds you need, having a yard sale to earn some extra cash, as well as cutting back on the amount money you currently spend and saving your money until the desired amount is obtained. If you find that you are out of options and simply cannot ask for money, work overtime, etc., then a loan is obviously necessary.

A fast cash loan can inevitably save you from getting even further behind on your bills assuming that you have the funds to repay the borrowed amount. If you need more money than what you qualify for at a certain company, you can also apply at other loan companies until you have collected the desired amount. Payments are usually stretched out over a long period of time, providing you with the opportunity to still have money at the end of the week. If you get behind, most companies will work with you until you can get caught up on payments. All in all, applying for a fast cash loan is a great choice when you need it.

Find Out How Your Money Troubles Are Saved With A Fast Cash Loan

Fast cash loans are so common in this day and age that you can almost predict you'll see a place to get one around every other corner you turn throughout your day. This is because there are sudden situations in life that require cash then and there, no questions asked but not everyone is so lucky to be able to have funds set to the side for such an event. Although cash loans may not solve big problems like trying to by a car but if you need a new washer/dryer or a part like a water pump to repair a vehicle, a quick cash loan could be the answer to your problems.

Commonly, fast cash loans are able to be found in your local area in many ways including newspaper ads and the local phonebook but the new age way of finding the right cash loan for you and your particular situation is to go online. Many lenders are now easily found online and for good reason: everyone is online, therefore so are the money lenders. You can easily search for and find multiple small loan lenders simply by using a major search engine and using the right keywords to find the loan right for you.

Commonly, fast cash loans are able to be found in your local area in many ways including newspaper ads and the local phonebook but the new age way of finding the right cash loan for you and your particular situation is to go online. Many lenders are now easily found online and for good reason: everyone is online, therefore so are the money lenders. You can easily search for and find multiple small loan lenders simply by using a major search engine and using the right keywords to find the loan right for you.

Every loan comes with its terms of agreement including how much the loan is for, the interest rate on the amount in loan and any other fees that are included in the transaction as well. Paying attention to such details is a very important step i.e. reviewing the loan before signing it and finding an error in how much money was being loaned to you could literally save you from getting in even more financial trouble. It goes to show that paying attention to every detail will keep you safe instead of sorry.

Payday Loans for Bad Credit Borrowers - Fast Cash and No Credit Check Required

The loan market of today is far different from what it was even a few years ago. With the Great Recession of the 21st century, the definition of good credit and bad credit has been redefined as more and more borrowers fall on hard times. Though the process of getting traditional unsecured loans remains much the same, the environment surrounding faster options has changed dramatically. For those with bad credit, no credit check loans or payday loans offer a solution that they may not have had before. This is enhanced by the internet which allows for easy comparison shopping and instant access to funds.

Why No Credit Check Loans?

Why No Credit Check Loans?

If you have bad credit, unsecured loans from traditional banks are basically impossible to come by and, if approved, take forever to process. Therefore, when you need a fast way to receive cash up to $1,500 the best option is to get a no credit check loan, also known as a payday loan. These small, short-term loans can give you an instant cash infusion at a time of need and then be promptly repaid with little hassle. Because they do not require a credit check, bad credit will not stop you from getting the money you need through payday loans.

You Must Meet Minimum Qualifications

Of course, this is not free money, so you much meet minimum standards in order to receive a payday loan. These are basic criteria, however, so they should be easy to fulfill. The qualifications include:

· Being at least 18 years old.

· Having a job for six months with a reliable paycheck.

· Having access to a bank account.

· Proving U.S. citizenship or permanent residence.

As long as you meet these basic qualifications, a payday lender will extend you a loan with no credit check required.

Understanding Your Options

Payday loans are not the same as traditional unsecured loans for two reasons: they are for small amounts of money and they are for short periods of time. You will generally be able to borrow between $100 and $1,500, depending on your income. Also, you will be expected to repay this money in 14-30 days, though some payday loans can carry terms of up to 60 days.

When you contact payday lenders about getting a loan with no credit check, it is important that you understand these options and determine which will work best for you. Because of the nature of payday loans, you will need to be prepared to pay them back fast. This is because they carry hefty fees in the case of late and delinquent payments. The convenience of receiving a loan with no credit check is offset by large penalties for failure to repay them on time.

Researching Lenders

The internet has been the best thing to ever happen to no credit check loans. Because you no longer have to rely on the only payday lender on the block, there is a choice of who you borrow from and the terms that are offered. When looking for a payday loan it is necessary to research several lenders and get quotes from all of them before making a decision.

Fast Cash Payday Loan : Use The Facility Only For Your Truly Urgent Needs

Fast cash payday loan is a genuinely beneficial service when properly used for actual pressing needs. Use of fast payday loan or fast cash advance payday loan for trivial whims must be completely avoided.

Fast cash pay day loan services are availed by a large number of salaried people in the U.S. these days. This cash loan service appeals to the people because of lenient qualifying criteria. To be eligible for this service, you just need to be a legal U.S. citizen, 18 years old or above. In addition to this, you should have a (usually) 3-month old account capable of electronic transactions. And you should be earning approx. $1000 per month. As would be obvious from the perusal of these criteria, most people are able to fulfill them.

Fast cash pay day loan services are availed by a large number of salaried people in the U.S. these days. This cash loan service appeals to the people because of lenient qualifying criteria. To be eligible for this service, you just need to be a legal U.S. citizen, 18 years old or above. In addition to this, you should have a (usually) 3-month old account capable of electronic transactions. And you should be earning approx. $1000 per month. As would be obvious from the perusal of these criteria, most people are able to fulfill them.

If you fulfill these criteria, processing of your application takes a day or so. This convenience, however, has led many people into the habit of obtaining fast cash loans and spending them unwisely on electronic items and other extravaganza. Using payday loans to fulfill your whims is simply akin to digging your own financial grave, so to speak. A large number of people have landed in terrible financial crunches owing to such acts. To avoid such situations, you must resolutely avoid the temptation of obtaining cash loans to fulfill your desires. Instead they must be used only for urgent requirements. Here's a basic idea when to avail cash advance services and when to avoid them.

The Needs That Call For Availing Fast Cash Advance:

A payday loan may be used for payment of any kind of bills like medical bill or utility bill that can't be deferred till your next paycheck arrives. Late payment of such bills invites penalties, which are usually equal to or greater than the interest charged by most lenders. You can also utilize fast cash services to meet an urgent repair work in your house like plumbing work that can't wait till your payday. Using the amount to get your car repaired is also justifiable, as your work might suffer for want of a vehicle to commute. Urgent needs related to studies of your children or requirement of funds for making unavoidable journeys are also some of the occasions when you can opt for fast cash payday loan.

When To Avoid Advance Services:

Just avoid using the advance for buying the items that you don't urgently need but only desire to own. Some examples of such items are electronic items (televisions, refrigerators, ovens etc.); clothes & shoes; toiletry (make up items, perfumes etc.); and furniture & decorative stuff for your house (beds, sofas, curtains, bed sheets, pillows). In almost all instances, purchasing such items can be deferred till the date of your next pay or better still till you have enough money to spare for them. Use of the money for unnecessary travel trips is also better avoided.

Fast Cash Loans: Are They A Good Or Bad Idea?

Money is tight these days and many people are living from paycheck to paycheck. This leaves them little savings should their car need repairs, a family member get sick or any other type of emergency. Should the unthinkable happen and you need cash quickly to tide you over, where would you turn for help? Many people are turning to fast cash loans to provide a temporary solution to an immediate problem.

What Is A Fast Cash Loan

A fast cash loan is what is known as a payday loan. It is a short term loan where you can borrow money quickly and easily and even with poor credit until your next payday. You can either apply for these loans in person at one of the local fast cash businesses or apply online without ever leaving your home. In many cases, you can have the money within minutes of applying. All you really need is a bank account.

What Is A Fast Cash Loan

A fast cash loan is what is known as a payday loan. It is a short term loan where you can borrow money quickly and easily and even with poor credit until your next payday. You can either apply for these loans in person at one of the local fast cash businesses or apply online without ever leaving your home. In many cases, you can have the money within minutes of applying. All you really need is a bank account.

In exchange for the loan you write the company a post dated check for the date you will pay back the loan. In most cases, the longest period is two weeks or until your next payday. Interest on these loans is usually about 15% meaning that if you borrow $100.00 you write the post dated check for $115.00. However, some of these loans in some states have been known to charge much higher interest rates so make sure you find out what the interest rates are before applying for one of these loans. If you can't pay the loan when it comes due you may be able to roll the loan over to the next payday for another $15.00 interest rate. Which means that you will want to pay one of these loans off as fast as possible to keep the interest from adding up.

Benefits

There are some benefits to fast cash loans and these benefits include:

You can borrow a small amount of money, Usually up to $1500.00 fast when you simply can't wait days to find out if you qualify for a bank loan.

You can the money you need for a real emergency even if you have bad credit.

You don't have to have collateral for a fast cash loans, nor do you have to fill out pages of paper work, just a simple application.

Disadvantages

There are several disadvantages of fast cash loans you have to consider. These include:

The high interest rate. 15% is an extremely high interest rate and if you have to roll over these loans this interest rate keeps adding up making it more and more difficult to pay off these loans.

If you are already living week to week then paying off any loan will be difficult.

Fast cash loans are illegal in some states so, you may not be able to get one of these loans depending on where you live, unless you apply online for a loan from another state.

While a fast cash loan can help you should a real emergency arise, you should use such loans sparingly and only if you really need one. They can be a real help to those who need money fast every occasionally but, can also become a burden when the interest piles up from taking out too many of these loans.

How to Get 1,000 USD Payday Quick Cash With a Bad Credit Fast Cash Loan

In today's economy finances are haunting millions of Americans each day. If you find yourself losing the battle with debt you've got to know you're not alone.

People often get so far into debt that what they have to pay back every month combined with what they need to live on is more than what they're bringing in on their paychecks.

That's where a bad credit fast cash loan could come in handy.

How Do You Manage To Get A Bad Credit Score?

Do you remember when you got your first credit cards?

People often get so far into debt that what they have to pay back every month combined with what they need to live on is more than what they're bringing in on their paychecks.

That's where a bad credit fast cash loan could come in handy.

How Do You Manage To Get A Bad Credit Score?

Do you remember when you got your first credit cards?

You started out feeling great because you could flash your credit cards to buy anything you wanted. In your mind you told yourself you could pay it back easily - after all, the minimum amount you had to pay back every month was very little. So it seemed you would have fantastic buying power forever.

As you know, it doesn't always happen that way.

What often happens is you max out your credit cards in the blink of an eye and you then come to a rude awakening: the minimum amount due can balloon into an off-the-wall debt with sky-high interest rates.

Then, if you begin defaulting on your credit cards or other debts, you credit score starts to plummet. And before you know it you're at the bottom of the credit barrel.

There Is A Way Out - The Bad Credit Fast Cash Loan

What happens next can be very disturbing. If you try to apply for a regular loan the chances are it will either be denied or, if by some miracle you do get an offer, it will be at huge interest rates and seemingly impossible terms and conditions.

Banks and other regular financial institutions look at you as a high risk investment because of your low credit score. It can become very tough to get a loan from them.

If you ever find yourself in this situation and you need emergency money, consider applying for a bad credit fast cash loan. Even in this situation people often get payday quick cash for $1,000 or more.

Your advantage is that because these loans are calculated to take into consideration borrowers with bad credit records, the lenders don't require any credit verification. Their risk is built into the price.

What this means to you is that the loan can be both processed and approved quickly even if you have an extremely low credit score.

The bad credit fast cash loan gives you an easy way out. But be careful to only use this service in an emergency.

In the long run you want to get out of your debt problems. Look into debt consolidation options and all the other things you can do to successfully climb out of debt.

You also have to remember that the bad credit payday loans - along with whatever amount of payday quick cash you borrow - are high interest loans which could very easily spiral out of control. Use the service wisely and carefully.

Acquiring a Cash Loan Fast - It's a Viable Option

Are you looking to acquire a cash loan fast, safe and conveniently? Everyone has run into an emergency situation at one time are another, some were able to handle the situation fairly well while others found themselves pulling their hair out or biting on their nails at a fast pace due to anxiety. The good news is that there are people in business that are there to help you out of emergency financial situations. Let's face it; most unexpected or expected occurrences that happen can be unavoidable, especially when it comes to living expenses. Power bill, car notes, mortgages and other financial engagements can require immediate attention if you want to continue living comfortably. Cash loan fast, safe and conveniently can solve these problem rather easily.

Why do such things like falling behind on your mortgage or car note happen in the first place? Why do we allow our cable bills, light bills, gas bills or water bills to double or triple up so often as well? These situations happen primarily because people either have other things to do with their money and they assume nothing will happen as long as they pay "something" on the bill; nevertheless, they find themselves in a bind where needing a cash loan fast becomes a viable option.

This is a relatively simple process for anyone looking to get a hold of some extra cash to take care of major or minor financial issues. Many people aren't aware that obtaining these types of loans online also come with benefits; for example, there simply no opportunity whatsoever of your sensitive information being hacked into because there's a guaranteed secured transaction. Next, the most important benefit of all for many people is the fact that every penny of your approved amount will go directly into checking account immediately. The funds will be electronically transferred and a cash loan fast and efficient will be completed.

Advantages and Disadvantages of Online Fast Cash Or PayDay Loan

Online cash loan is faster compared to normal lending financial institution or bank as such loans are available quickly and easily to solve your urgent financial needs. There is no longer a need for you to wait for weeks to get your credit history evaluated and approved. With online cash loan, or payday loan, all you need is to fill up an online application form and your money will be credited to your bank account within 24 hours. Simple isn't it?

However, before taking up an online loan for your fast cash needs, I would like to highlight the pros and cons so that you have a better understanding of it.

Advantages Of Online Fast Cash Or PayDay Loan:

However, before taking up an online loan for your fast cash needs, I would like to highlight the pros and cons so that you have a better understanding of it.

Advantages Of Online Fast Cash Or PayDay Loan:

1. Low Qualification Criteria To Get Approved

Different online cash loan companies have different sets of lending criteria yet in most cases, you only need to be at least 18 years old, have a permanent employment and have a valid bank account.

2. Bad Credit History Might Not Be A Issue

Some companies may even approve your loan if you have bad credit history or without perfect credit. It will be difficult for you if you opt to apply in banks or credit card companies.

3. Lesser Paper Work And No Fax

In most cases, you need not submit long list of your credentials for approval. Very little paper work will be involved since all the application process is done online. No faxing is required as well.

4. Can Be Done Online Easily

Well, since it is an online cash loan company, naturally all the application and approval procedures are done on the internet. There is no need for you to join long queues just to get a loan anymore.

Disadvantages Of Online Fast Cash Or PayDay Loan:

1. Higher Loan Interest Rates and Fees

Loan interest rates and fees charged for online cash loan are higher compared to normal loans. Interest rate is calculated in APR (Annual Percentage Rate). It is hence not recommended to use it as the first option if you are not in need of urgent cash.

2. High Late Fees If You Don't Repay On Time

It can be quite costly if you do not repay your loan on time. You need to pay late fees and this would increase your loan amount more than you can imagine. You may even ended up paying double the amount you received in advance. Hence you should plan and keep track of your repayment schedule well.

3. Short Repayment Period

Unlike traditional financial lenders which give you a term of a year or two, online cash loan companies typically require you to repay your loan within a few weeks.

4. Hidden Or Unclear Terms And Conditions

Certain high risk terms and conditions might be intentionally hidden or made unclear by some companies in the form of fine prints or whatever. Make sure you read them carefully and thoroughly.

A Fast Cash Loan - Fast Cash Loan For Fast Credit

If you have poor credit but you are employed, you can use a fast cash loan to rebuild your credit rating. Simply visit one of the many different fast cash lenders and upon producing proof that you have a job, your loan approval will generally be approved within minutes.

You can use the money that you receive from your fast cash loan for whatever you want, whether it is paying the rent, utility bills or even for buying gifts. When you get your salary, you can pay the money back to the lender. This will give your credit rating a boost.

You can use the money that you receive from your fast cash loan for whatever you want, whether it is paying the rent, utility bills or even for buying gifts. When you get your salary, you can pay the money back to the lender. This will give your credit rating a boost.

Giving your credit rating a boost is important if you are planning on borrowing money in the future for buying a car or a house. Even if you just want more spending power in your credit cards, it pays to build up your credit rating.

By using these types of short term loans, you can gradually regain your credit rating. This means that each time you obtain a fast cash loan; you will be able to borrow more money than before. This is because you are now a good credit risk and have proven that you are worthy of getting more money.

Whether you need the cash right away for an emergency or you simply want to rebuild your credit or even build up non-existent credit, you can do so by obtaining a fast cash loan. These loans are simple for anyone to obtain, hassle free and can be used get right away while at the same time improving your credit rating.

Fast Cash Personal Loans - When Do You Need A Fast Personal Loan?

Just about everybody needs a little financial boost from time to time. If you find yourself in a situation with unexpected expenses, a fast cash personal loan may be the answer you are looking for.

Getting a personal loan online is much easier than it was five years ago. New advancements in online forms and secure web pages have made it easier, faster, and more secure for loan applicants to get an instant approval for a personal loan online. In addition to the hundreds of lenders who specialize in these fast loans, even more traditional financial institutions have branched out into the world wide web.

Getting a personal loan online is much easier than it was five years ago. New advancements in online forms and secure web pages have made it easier, faster, and more secure for loan applicants to get an instant approval for a personal loan online. In addition to the hundreds of lenders who specialize in these fast loans, even more traditional financial institutions have branched out into the world wide web.

But when do you need a fast personal loan? For some people it's unexpected medical bills. For others it could be just trying to avoid late charges on credit cards or other installment accounts, and it may make sense to consolidate some smaller bills into a personal loan. Maybe you have had a loved one in need of emergency funds, and you would have helped if you had the extra money on hand. Also, most banks won't write an auto loan for less than five thousand dollars. But what if you just need some reliable transportation for work? You wouldn't have to spend $5000 for that, right? These are just some of the reasons you may need a personal loan online.

If you are considering a fast personal loan, just make sure you are comfortable with the payments before you finalize anything. That way, you can pay off the loan quickly and easily.

Fast Cash Loan - Get Out of Debt and Put Your Family "Back on Track"

For humans, there is a so-called "race of life". This is really different from the car racing. There is a slight similarity though. Just imagine when you are in the middle of the race track -trying to take the advantage against your opponents. Suddenly, a bigger car hit your bumper. Obviously, you will lose your focus. How can you imagine hearing the grazing of metals - bswing! On the same way, we can compare our life to such situation. As we all know, life is full of challenges and obstacles. By the time we're on the way to fulfilling our dreams, emergencies will come across most especially in financial aspect. Good thing to know that there are instant options like cash loan - to provide speedy cash whenever we need it.

Get rid of unplanned expenses

Get rid of unplanned expenses

Emergencies are also known as unplanned expenses that are about to happen. Unfortunately, these are unpredictable circumstances that might ruin your life, family and career. Not all the times we have money to support our needs. There comes a point wherein we walk down the street with empty-handed. What if you need medication in case you got sick? What will happen if you failed to pay your child's schooling fee? These are just some of the situations that one might encounter.

Now, to get out of debts and keep your family on the right track all you need is a preparation. As such, instant options like cash loan are present. These are loan options intended for short-term expenses such as past due bills, tuition fees, rentals and debts.

In comparison with banks and retail lending companies, online lenders can deliver the cash in a fast and secured manner. There is no need to visit the loan provider's office or to fax dozens of documents just to claim the cash on time. All you need to do is to sit down in front of the computer and make your application through email.

One hour after you sent your application, the lender will send a confirmation email whether your application is approved or denied. Once your application has been approved, you can claim the money through SSN or checking account. The lender will also notify you in case your application has been rejected. There's no need to wait for a long time to know the result.

If there's a great blessing a debtor can receive, that would be the presence of instant options like cash loan. So, what are you waiting? Do your own research and look for a trusted loan provider. However, you should be cautious as there are loan companies that tolerate hidden ticketing costs among debtors. Read the fine print as well. In this small print, you'll find everything including some terms and know-hows.

How A Quick Loan Approval Can Help You Solve Your Financial Difficulties

With more people relying on credit cards and creating considerable debt due to economic difficulties, it is becoming harder to save for future needs and to exercise sound financial management. Whether you have accumulated a few debts or facing a blacklisting, there are options available to assist in working towards a financially free status. Quick loan approval can be received for bad credit and payday alternatives to settle the outstanding bills.

When you accumulate debt whether on personal accounts or a credit card, it will include a high interest rate on the repayment. For many people, the interest charged is so high that it is impossible to settle the outstanding bill as you try to catch up to the repayments. This is a major contributing factor to accumulating debt leaving many with few options when emergencies strike and access to funds is necessary.

When you accumulate debt whether on personal accounts or a credit card, it will include a high interest rate on the repayment. For many people, the interest charged is so high that it is impossible to settle the outstanding bill as you try to catch up to the repayments. This is a major contributing factor to accumulating debt leaving many with few options when emergencies strike and access to funds is necessary.

There is the option to look for instant approval bad credit or regular payday loans that serve as the quickest solutions for your money related problems. Fast cash is one of the easiest ways to receive finances for emergencies particularly when things become tight until your next pay check. Perhaps you have maxed the credit card and are unable to purchase essentials for the month or need cash to settle an outstanding debt, a quick loan approval can provide significant relief.

A bad credit loan is an option that is available for individuals with poor FICO scores that require access to funds in emergency situations. Should an unexpected life event occur, you may not be able to obtain the necessary finances through conventional financial institutions. Seeking alternatives from a reputable lender can help you when facing dire straits.

Remaining aware of mistakes that have been made in he past and perhaps consulting with a financial counselor can assist in better management of your finances. Reliance on quick loans should only take place if you will be able to settle the finances on your next pay day. If you are unable to stick to responsible management practices then it may be best to avoid such options.

The payday loans are fast becoming the easiest ways to obtain cash for those with bad credit and who are simply experiencing a shortage of money for the month. There are a number of advantages provided with such alternatives as long as research into the requirements is implemented and you are aware of the fine print. Always ensure that the company you are borrowing from is reliable and reputable in the industry.

A major advantage of seeking payday loans is the speed and efficiency within which the funds can be obtained. There is the option to visit the lender or to complete an online application where you will be able to receive money straight into your bank account within a matter of minutes. With alternatives such as obtaining credit, a credit worthy test will be performed to determine whether or not approval is received.

These types of finances can be obtained without complicated processes, which means that you do not have to possess favorable credit in order to be approved. The lender will simply require information such as proof of employment, active banking accounts, and income per month. Individual checks may be performed, but this will simply determine the amount of money that you qualify for.

Quick loan approval also means greater flexibility as you will not be restricted in terms of how to spend the cash. While it is always necessary to use such finances for emergency situations and pressing financial matters, the lender will not stipulate the conditions and terms according to which the funds can be used. Exercise responsibility and manage your money to prevent from accumulating additional debts and complicating your monetary situation.

If you see payday loan lenders, ensure that the company is in fact reputable. While such options can offer numerous benefits, assess the interest that is charged on finances before rushing out to apply for loans. It is also important to take into account that such businesses will require that the borrowed sum is to be paid in full with your next salary.

Subscribe to:

Posts (Atom)